When you are building an auto insurance policy and comparing auto insurance quotes, there are a variety of different ways to keep your premiums low. If you plan on carrying both comprehensive and collision insurance to protect your vehicle, it will be your job to select a deductible for comprehensive cover and a deductible for collision cover. Before you select a deductible, it is important to understand what exactly this figure means, and how the figure can affect your premiums. Here is your straightforward guide to understanding auto insurance deductibles and tips that you may find useful.

How Do Auto Insurance Deductibles Work?

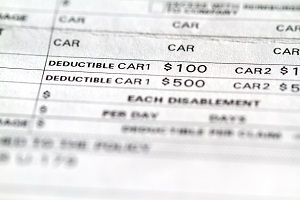

An insurance deductible is the amount of money that you must pay toward repairs on your vehicle when you are filing a claim for a covered loss. If your vehicle is damaged and the damages do not exceed your deductible, you will have to pay for the repairs out-of-pocket unless a third-party is found negligent. When you are comparing the rates for insurance policies from various car insurance companies, you will need to select two separate deductibles for comprehensive and collision insurance. If you have a $500 deductible on comprehensive and a vandal causes $3000 of damage to your vehicle, the insurer will pay $2500 for repairs. Deductibles are always subtracted from the claims payment before the company cuts a check to pay the shop or the policyholder.

How Auto Insurance Deductibles Affect Coverage Premiums

The premiums associated for comprehensive and collision cover are based on the type of vehicle you own, your driving record, and also the deductibles that you have selected. For comprehensive insurance, companies typically offer deductibles between $50 and $2000. For collision insurance, companies will typically offer a wide range of deductibles between $100 and $2000. If you select a lower deductible for either comprehensive or collision, your premiums for these coverage options will go up. If you select a deductible at the higher end of the range, your premiums for the coverage option will be lower. If you are looking for the cheapest possible auto insurance policy, it is in your best interest to choose a high deductible. With this being said, you should only select deductibles that you can afford to pay if you ever file a claim.

Tips When it Comes to Auto Insurance Deductibles

If the difference between a $100 collision deductible and a $1000 collision deductible is $450 per year, consider how long it will take you to go claims free to break even. You will be saving $450 per year, but you will pay $900 more out-of-pocket if you file a claim. It will take 2 years of not filing a claim to break even, and every additional year you go without filing a claim you will save an additional $450. If you are willing to take on more risk, this may be the best route to go as long as you are willing to put the money you save away to cover your higher deductible.

There is no such thing as full coverage auto insurance. Even policies with comprehensive and collision have deductibles, and you must pay your part to cover claims. Take time to compare the rates for various deductibles, think about what you can afford, and make the right decision.