A Glimpse of No-Fault Insurance, By State

Do you know your no-fault, auto insurance regulations?

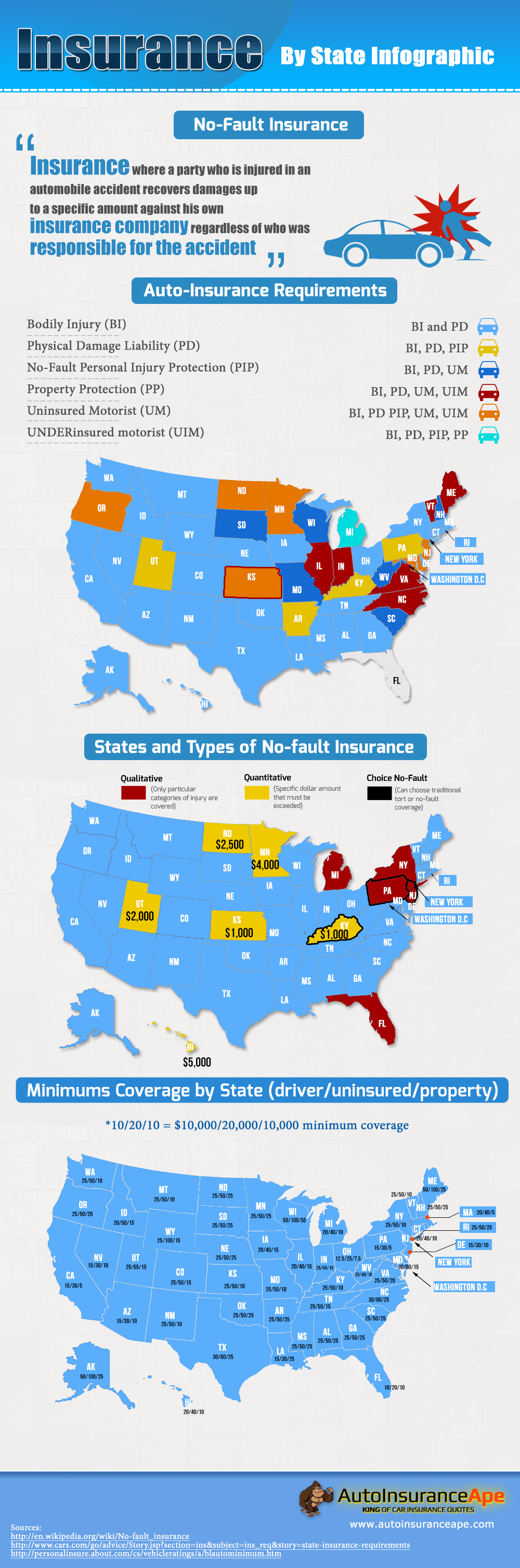

Across all fifty states that make up the good ole’ USA, automobile liability insurance is mandatory. As a result, there are four general tiers of car insurance: no-fault; choice no-fault; tort liability, and add-on options.

Today, we focus on the specificities of no-fault insurance; a type of insurance contract in which the insured (if injured in an automobile accident) is indemnified up to a specific amount by their designated insurance company. In light of the arduous and expensive court battles that are often required to determine the party at fault, no-fault insurance is intended to lower the cost of auto insurance by taking small claims out of the courts.

Given the fact that auto insurance coverage in the U.S. is state-tailored, there are quite a few discrepancies that all drivers should be made aware of, in the event of a possible accident. Let’s take a look at the following infographic to better gauge your no-fault, auto insurance options!

Sources:

http://en.wikipedia.org/wiki/No-fault_insurance

https://www.ecoverage.com/articles-what-is-no-fault-auto-insurance-and-which-states-have-it.php

http://www.cars.com/go/advice/Story.jsp?section=ins&subject=ins_req&story=state-insurance-requirements

http://personalinsure.about.com/cs/vehicleratings/a/blautominimum.htm